Did you know?

A tax lien Withdrawal is different than a tax lien release? A Withdrawal removes the public tax lien record and helps assure other creditors that the IRS will not compete for your property and other assets.

a claim for credit or refund must be filed within 3 years from t...

"An NFTL [Notice of Federal Tax Lien] filing determination is not required on Guaranteed/Streamlined Installment Agreements or In-Bu...

If you've looked at IRS form 433-A(OIC) closely, you've seen the $1,000 exclusion the Service allows for bank accounts. What you may not know is that the IRS may also allow you to exclude one month's living expenses from the balance in your checking account at the time you submit your Offer in Compromise.

If you'd like to know more about the IRS Offer in Compromise, check our website, then ...

Are you self employed with an IRS back tax debt? You may be wondering whether or not the Offer in Compromise is the right fit to resolve your tax liabilities. A lot depends on your equity in assets and your ability to make monthly payments toward the back taxes.

If you have tools of trade that you use to produce income, the IRS will treat them differently than other assets you own. The IRS...

Did you know that the IRS has many online tools that are designed to help you understand your tax responsibilities, answer your questions and reduce the time it takes to get information from the IRS? Interactive forms, calculators and other tools are available to you right now, at no cost.

Fresh Start Tax Relief has put together five free tax resolution guides to help answer your questions and get you started resolving your federal back tax liabilities. Get them before you pay anyone to help you fix your back tax problem.

Your IRS tax debt could be easier than you think to resolve. You may be able to set up a formal installment agreement with the IRS...

Execute Your Tax Resolution Plan

Execute Your Tax Resolution Plan

If you recently had an IRS tax lien filed against, you've likely received several phone calls and letters from companies wanting to help you resolve your back taxes. A lot of these companies use scare tactics to get you to hire them. All of them, to some extent, are betting on you sticking your head in the sand to avoid dealing with the IRS.

If you recently had an IRS tax lien filed against, you've likely received several phone calls and letters from companies wanting to help you resolve your back taxes. A lot of these companies use scare tactics to get you to hire them. All of them, to some extent, are betting on you sticking your head in the sand to avoid dealing with the IRS.

If you owe back taxes to the IRS and you've received a notice from the Service, your case may be in IRS collection status. Once the IRS starts issuing notices to collect a past due tax debt, the machine is moving forward and the collection process has begun.

If you owe back taxes to the IRS and you've received a notice from the Service, your case may be in IRS collection status. Once the IRS starts issuing notices to collect a past due tax debt, the machine is moving forward and the collection process has begun.

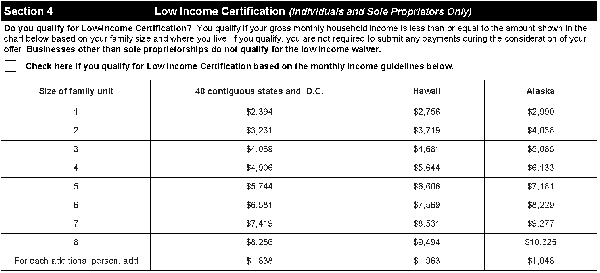

We all know that the IRS Offer in Compromise (OIC) is an option available to some delinquent taxpayers to settle their federal tax debt for less than the total amount owed. But the finer points of the OIC are what you need to know in order to successfully submit your Offer and increase your chances of success. Here's a quick tip for those delinquent taxpayers that are really struggling financ...

We all know that the IRS Offer in Compromise (OIC) is an option available to some delinquent taxpayers to settle their federal tax debt for less than the total amount owed. But the finer points of the OIC are what you need to know in order to successfully submit your Offer and increase your chances of success. Here's a quick tip for those delinquent taxpayers that are really struggling financ... Fresh Start Tax Relief recently had a client that needed to know whether or not he qualified for the IRS Offer in Compromise (OIC). Most of the facts were in his favor. His IRS tax debt totals more than $30,000. His family's monthly expenses do not exceed the IRS Collection Financial Standards. He has zero disposable monthly income and cannot make a monthly payment toward his tax debt. His...

Fresh Start Tax Relief recently had a client that needed to know whether or not he qualified for the IRS Offer in Compromise (OIC). Most of the facts were in his favor. His IRS tax debt totals more than $30,000. His family's monthly expenses do not exceed the IRS Collection Financial Standards. He has zero disposable monthly income and cannot make a monthly payment toward his tax debt. His... The IRS charges hefty penalties for failing to file a tax return on time when tax is owed. If you must file your personal 1040 tax return late, send the IRS form 4868 Automatic Extension of Time to File U.S. Individual Income Tax Return before the return due date. Remember, the Automatic Extension to File is not an extension to pay.

The IRS charges hefty penalties for failing to file a tax return on time when tax is owed. If you must file your personal 1040 tax return late, send the IRS form 4868 Automatic Extension of Time to File U.S. Individual Income Tax Return before the return due date. Remember, the Automatic Extension to File is not an extension to pay.