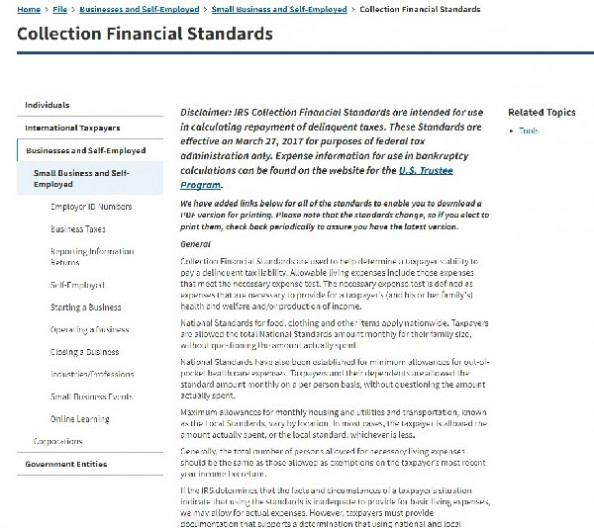

The IRS uses the Collection Financial Standards to help calculate your ability to pay a back-tax liability.These limits on monthly living expenses play a significant role in your ability to qualify for the Offer in Compromise settlement program and your Offer amount. The Standards are revised each year around the end of March.

Quick IRS Offer in Compromise Tip

If you’re preparing your OIC for submission toward the end of March, consider waiting a week or so before sending it to the IRS. It may be a good idea to wait for the Collection Financial Standards to update. It could put money in your pocket. But, don’t wait too long and get yourself into trouble.

We hope this helps.

Contact us to find out how fix tax problems.

0 COMMENT(S)

POST A COMMENT

E-mail (required but not shown)