What if I can't afford to submit my OIC to the IRS

Jan 4, 2016 by

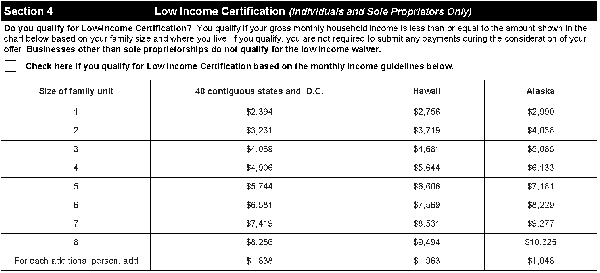

If you meet the Low Income Certification requirements, you will not be required pay the IRS $186 Offer in Compromise (OIC) application fee, nor will you be required to send in your first monthly payment or make monthly payments while your OIC is under review. See the table below and IRS form 565 for more information.

*Taken from IRS Offer in Compromise Booklet revised 01.2014

When you hire Fresh...

be the first to add a comment