Tax Relief Blog

Category:

IRS Tax Settlement

Offer in Compromise First Step

Mar 27, 2018 by

The Offer in Compromise is considered the Holy Grail of Tax Relief. The IRS settles a back-tax debt for less than the total amount owed. How much less? Well, that depends on your specific set of circumstances. Each Offer in Compromise is different, depending on the taxpayer.

One thing that’s consistent about all OICs is the list of prerequisites.

Tax Compliance Top Priority

Make compliance your first step. You’ve got to be in current tax compliance before submitting your OIC settlement r...

be the first to add a comment

IRS Collection Statistics

Mar 13, 2018 by

Sometimes carrying the weight of an IRS tax debt can lead to a lonely place. But, don’t beat yourself up too much. There are ways to fix the problem. You’re not a bad person because you owe taxes. And, you’re not alone, that’s for sure.

The IRS recently released some statistics from their collection of delinquent tax liabilities.In 2016 the IRS added 7,652,000 new tax delinquent accounts for a total of more than $14 million unresolved accounts by the end of the year. All that adds up to m...

What if I can't afford to submit my OIC to the IRS

Jan 4, 2016 by

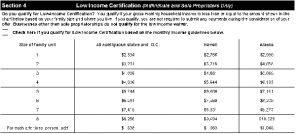

If you meet the Low Income Certification requirements, you will not be required pay the IRS $186 Offer in Compromise (OIC) application fee, nor will you be required to send in your first monthly payment or make monthly payments while your OIC is under review. See the table below and IRS form 565 for more information.

*Taken from IRS Offer in Compromise Booklet revised 01.2014

When you hire Fresh Start Tax Relief, we'll help you determine your total tax debt, your total penalty balance, your CS...

Your Rights As a Taxpayer

Apr 27, 2015 by

Your Rights As a Taxpayer

IRS Publication 1, Your Rights as a Taxpayer is a must read if you have fallen behind with your federal taxes. It is a quick two pages, but contains some great information and answers some common questions such as:

Will the IRS think I'm guilty if I hire a professional to represent me?

IRS Pub 1, #9 states that "Taxpayers have the right to retain an authorized representative of their choice".

So if you are too anxious to talk to the IRS yourself, hiring a qualified re...

Get Your IRS Account Transcript

Mar 30, 2015 by

Fresh Start Tax Relief's service includes obtaining IRS Account Transcripts for our clients. We then review and analyze the transcripts to help determine penalty and interest amounts, compliance and threat of enforced collection actions such as bank levies and wage garnishments.

You can get started on your own investigation and compliance check by ordering your own transcripts online. Get them directly from the IRS here.

If you need help ordering and analyzing your IRS transcripts, call u...

Do I really qualify for the IRS OIC, CNC, PPIA, IA or Penalty Abatement

Feb 9, 2015 by

What makes choosing a tax resolution company so difficult? I think it's all of the different promises, guarantees and options you hear about on the T.V., radio, online and from salesmen over the phone. I've seen a commercial that said IRS tax debts can be settled for 10% of the total amount owed. A radio ad I recently heard stated that new government programs are available to lower tax debts substantially and if I owe $10,000 or more I could qualify.

The problem with this is that the IRS d...

IRS Electronic Payment Options

Nov 17, 2014 by

The IRS offers many different ways to pay your tax debt. You can pay electronically in the following ways.

- With a credit card

- Through Direct Pay with the payment coming directly out of your checking or savings account

- Through the Electronic Federal Tax payment System (EFTPS) and

- You can even send a same-day wire transfer

Browse Fresh Start Tax Relief's website f...

First Time Penalty Abatement

Nov 3, 2014 by

At Fresh Start Tax Relief we want to help people get out from underneath of their IRS tax debt without paying high fees to tax resolution firms and attorneys. Most individuals that owe a tax debt to the IRS can resolve it without outside help. You can even request the removal of penalties on your own.

Here are two tips to help you remove IRS penalties on your own.

The IRS can remove penalties over the phone. However, there is a dollar threshold. Although the dollar threshold changes f...

Do I Need a Tax Attorney to Resolve My IRS Back Taxes?

Sep 22, 2014 by

This is a question that we hear frequently. I think there are quite a few salesmen out there that tell prospective clients that without a tax attorney, they won't be able to do certain things while negotiating their back taxes with the IRS. This really isn't true. The IRS states that Enrolled Agents, certified public accountants and attorneys have unlimited practice rights before the IRS. This means that any of them can fully represent a delinquent taxpayer before the IRS Collection divis...

How Do I Prepare the IRS Offer in Compromise Form?

Sep 2, 2014 by

The average IRS Offer in Compromise takes a tax professional about 35 hours to complete from start to finish. Multiply that by an hourly rate of just $100 and you have a $3,500 fee on your hands. Good luck finding a tax resolution professional that's any good to work for less than $200 per hour. And if you're hiring an attorney, that hourly rate is likely to be between $250 and $500.

A lot of tax resolution professionals out there sell their clients the IRS Offer in Compromise before they ...

Tax Resolution Fees

Aug 11, 2014 by

Reasonable fees are always a concern when you're looking help resolving and reducing your back IRS taxes. Depending on your case, tax resolution companies charge anywhere from $500 for an investigation only up to $10,000+ for larger cases.

Fresh Start Tax Relief's fee is $499. It doesn't change. Here's what you get.

- Investigation of your IRS back tax case

- Analysis of your Collection Potential to determine your best resolution options

- A copy of your IRS Account Transcript...

Offer in Compromise Low Income Certification

Jul 28, 2014 by

We all know that the IRS Offer in Compromise (OIC) is an option available to some delinquent taxpayers to settle their federal tax debt for less than the total amount owed. But the finer points of the OIC are what you need to know in order to successfully submit your Offer and increase your chances of success. Here's a quick tip for those delinquent taxpayers that are really struggling financially.

We all know that the IRS Offer in Compromise (OIC) is an option available to some delinquent taxpayers to settle their federal tax debt for less than the total amount owed. But the finer points of the OIC are what you need to know in order to successfully submit your Offer and increase your chances of success. Here's a quick tip for those delinquent taxpayers that are really struggling financially.The IRS OIC has an application fee of $186. If you meet the IRS Low Income Certification r...

IRS form 4868, Automatic Extension to File

Jul 7, 2014 by

The IRS charges hefty penalties for failing to file a tax return on time when tax is owed. If you must file your personal 1040 tax return late, send the IRS form 4868 Automatic Extension of Time to File U.S. Individual Income Tax Return before the return due date. Remember, the Automatic Extension to File is not an extension to pay.

The IRS charges hefty penalties for failing to file a tax return on time when tax is owed. If you must file your personal 1040 tax return late, send the IRS form 4868 Automatic Extension of Time to File U.S. Individual Income Tax Return before the return due date. Remember, the Automatic Extension to File is not an extension to pay. Form 4868 is a six month extension to file. If you do file for the extension, you must file your tax return by the six month extension deadline. If you don...

Fresh Start Tax Relief Helps People Help Themselves

Jun 30, 2014 by

If you've stumbled upon this blog, you're looking for help resolving your IRS tax debt. You may be wondering whether or not you can resolve your tax debt on your own or if you need a professional.

The answer really depends on the size and complexity of your tax debt, and your level of comfort with the IRS. We believe that most personal, IRS tax debts can be resolved quickly and easily with a little guidance. Guidance is exactly what Fresh Start Tax Relief offers its clients. When you hire ...