Tax Relief Blog

IRS Tax Lien, Transportation Expenses

Jul 6, 2015 by

Does your family have a vehicle? Two? Three?

If you are negotiating a back tax debt with the IRS, you may be subject to the Collection Financial Standards. If you have three vehicles in your family, the IRS may only allow the expenses associated with two of them when determining your collection potential.

In addition, they may not allow your whole monthly car payment or your monthly vehicle operating expenses. The Service has ceilings on these expenses for collection purposes.

They a...

be the first to add a comment

Do You Need Full Tax Representation Before the IRS?

Jun 29, 2015 by

At Fresh Start Tax Relief, an educated consumer is our best customer. We help capable taxpayers that have fallen behind with the IRS resolve their own tax debts at a fraction of the price of other tax resolution firms.

If you need full service tax resolution, we can provide you with that option through M&M Financial Consulting, our parent company. But the truth is that most individuals with federal tax liabilities are in a position to resolve their own tax debt directly with the IRS. Mo...

Do You Really Need Tax Resolution Help?

Jun 22, 2015 by

A lot of people with IRS back tax debts do not need help resolving them.

If you owe less than $10,000 in federal income tax, you likely don't need outside help resolving your back tax liabilities. You may be able to request a formal monthly Installment Agreement directly with the IRS online. Click here www.irs.gov/Individuals/Online-Payment-Agreement-Application to start.

If you are already in a formal monthly Installment Agreement with the IRS and you can afford the payments, you are pro...

What is a fair price to resolve your IRS income tax debt?

Jun 15, 2015 by

There are a lot of tax resolution companies out there vying for your business. I would say between 150 and 200 national companies. You may think that choosing from this pool of options is a difficult task. But, I don't.

To me the choice is clear. If you are willing to put a few hours of your own time into resolving your IRS back tax debt, then Fresh Start Tax Relief is the clear choice. We will investigate your IRS tax account and show you the steps needed to resolve your IRS income t...

Online IRS Tools

Jun 8, 2015 by

Online IRS Tools

Did you know that the IRS has many online tools that are designed to help you understand your tax responsibilities, answer your questions and reduce the time it takes to get information from the IRS? Interactive forms, calculators and other tools are available to you right now, at no cost.

- Free File

- IRS Withholding Calculator

- Online Payment Agreement

- Where's My Refund

- Withholding Calculator

- Offer in Compromise Pre-Qulaifier Tool

- Free Tax Return Preparation for You ...

Notice of Tax Lien Investigation

Jun 1, 2015 by

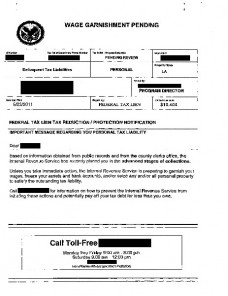

Have you received a "Notice of Tax Lien Investigation", "Wage Garnishment Pending" or "Tax Reduction/Protection Notification" in the mail?

Read it carefully. This may be a marketing ploy from a tax resolution company. They disguise their mailers to look like official IRS letters and notices. It gets a response from a lot of worried taxpayers that think they're contacting the IRS or state. To me it's a trick and has no place in Fresh Start's marketing. Here's an example of one.

...

Do Tax Resolution Services Work?

May 26, 2015 by

Do tax resolution services work?

Yes! But you need the right representation at a reasonable cost. Read more here.

How do I know if it will work for me specifically?

This will depend on your personal expectations and circumstances. In most individual IRS tax debt cases, a well planned phone call or two can resolve your income tax liabilities directly with the IRS. And, most people can do it themselves. They just need some initial guidance. Read more here.

What can a tax resolutio...

Fresh Start Tax Relief for Over the Road Truck Drivers

May 18, 2015 by

Over the road truck drivers keep the economy moving by delivering goods everyday across the country. Life on the road means that some things get put on the backburner. Sometimes taxes are left there for a while and back tax debts pile up.

Fresh Start Tax Relief can help you gain control of your back tax liabilities by contacting the IRS on your behalf to research and investigate your account. We'll also help determine the best way to resolve and reduce your back taxes through government...

Fresh Start Client Didn't Need Full Tax Representation, Just Guidance

May 11, 2015 by

At the end of 2014 Fresh Start Tax Relief was hired by a local Chicagoan. He lives two blocks from our office. A balance due on his 2013 1040 tax return prompted him to call.

He already had a formal Installment Agreement in place on a $2,500 tax debt from 2010 and wasn't sure how to handle an additional $10,000 tax debt from 2013.

Here's what we were able to help him figure out.

- His accountant did not eFile his 2013 tax return as promised.

- He will be able to include his new 2013 balance due ...

Asset Values in an Offer in Compromise

May 4, 2015 by

The IRS Offer in Compromise (OIC) is a great tool to resolve your back tax liabilities, if you qualify. The IRS looks heavily at your assets and your ability to pay monthly.

If the equity in your assets is more than you owe the IRS, you may not qualify for the OIC. But the OIC equity calculation isn't as simple as taking the fair market value of your asset and subtracting the loan balance. It can be much more in depth than that. For example, the IRS uses a Quick Sale Value (QSV) or liquida...