Tax Relief Blog

Do You Need Full Tax Representation Before the IRS?

Jun 29, 2015 by

At Fresh Start Tax Relief, an educated consumer is our best customer. We help capable taxpayers that have fallen behind with the IRS resolve their own tax debts at a fraction of the price of other tax resolution firms.

If you need full service tax resolution, we can provide you with that option through M&M Financial Consulting, our parent company. But the truth is that most individuals with federal tax liabilities are in a position to resolve their own tax debt directly with the IRS. Mo...

be the first to add a comment

Do You Really Need Tax Resolution Help?

Jun 22, 2015 by

A lot of people with IRS back tax debts do not need help resolving them.

If you owe less than $10,000 in federal income tax, you likely don't need outside help resolving your back tax liabilities. You may be able to request a formal monthly Installment Agreement directly with the IRS online. Click here www.irs.gov/Individuals/Online-Payment-Agreement-Application to start.

If you are already in a formal monthly Installment Agreement with the IRS and you can afford the payments, you are pro...

What is a fair price to resolve your IRS income tax debt?

Jun 15, 2015 by

There are a lot of tax resolution companies out there vying for your business. I would say between 150 and 200 national companies. You may think that choosing from this pool of options is a difficult task. But, I don't.

To me the choice is clear. If you are willing to put a few hours of your own time into resolving your IRS back tax debt, then Fresh Start Tax Relief is the clear choice. We will investigate your IRS tax account and show you the steps needed to resolve your IRS income t...

Online IRS Tools

Jun 8, 2015 by

Online IRS Tools

Did you know that the IRS has many online tools that are designed to help you understand your tax responsibilities, answer your questions and reduce the time it takes to get information from the IRS? Interactive forms, calculators and other tools are available to you right now, at no cost.

- Free File

- IRS Withholding Calculator

- Online Payment Agreement

- Where's My Refund

- Withholding Calculator

- Offer in Compromise Pre-Qulaifier Tool

- Free Tax Return Preparation for You ...

Notice of Tax Lien Investigation

Jun 1, 2015 by

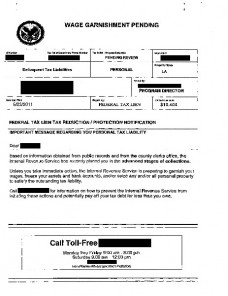

Have you received a "Notice of Tax Lien Investigation", "Wage Garnishment Pending" or "Tax Reduction/Protection Notification" in the mail?

Read it carefully. This may be a marketing ploy from a tax resolution company. They disguise their mailers to look like official IRS letters and notices. It gets a response from a lot of worried taxpayers that think they're contacting the IRS or state. To me it's a trick and has no place in Fresh Start's marketing. Here's an example of one.

...