Tax Relief Blog

Offer in Compromise First Step

Mar 27, 2018 by

The Offer in Compromise is considered the Holy Grail of Tax Relief. The IRS settles a back-tax debt for less than the total amount owed. How much less? Well, that depends on your specific set of circumstances. Each Offer in Compromise is different, depending on the taxpayer.

One thing that’s consistent about all OICs is the list of prerequisites.

Tax Compliance Top Priority

Make compliance your first step. You’ve got to be in current tax compliance before submitting your OIC settlement r...

be the first to add a comment

IRS Collection Statistics

Mar 13, 2018 by

Sometimes carrying the weight of an IRS tax debt can lead to a lonely place. But, don’t beat yourself up too much. There are ways to fix the problem. You’re not a bad person because you owe taxes. And, you’re not alone, that’s for sure.

The IRS recently released some statistics from their collection of delinquent tax liabilities.In 2016 the IRS added 7,652,000 new tax delinquent accounts for a total of more than $14 million unresolved accounts by the end of the year. All that adds up to m...

Pay the tax before or after requesting penalty relief?

Feb 27, 2018 by

We get this question a lot from clients and those that are simply seeking information. Sometimes its less of a question and more of a statement, something like –

“I’m not paying it until they take away the penalties!”

That’s fine, but you may not get too far that way.

The basic answer to the question is… pay it, then ask for relief. If you can’t pay it all at once, set up a monthly Installment Agreement, then ask for relief.

Tax Compliance Top Priority

The IRS wants to see a taxpayer in compli...

Your IRS Back-Taxes Could Affect Your Passport

Feb 13, 2018 by

Last month, January 2018, the IRS started reporting taxpayers with “Seriously Delinquent Tax Debt” to the State Department. In this case, seriously delinquent means $50,000+ adjusted yearly for inflation. So, if you fit the criteria below, your passport could be denied, revoked or limited.

- Owe $50,000+

- Notice of Federal Tax Lien has been filed, or

- A levy has been issued

- Installment Agreement

- Offer in Compromise

- Currently Not Collectible status

IRS Collection Financial Standards Update Yearly

Jan 30, 2018 by

The IRS uses the Collection Financial Standards to help calculate your ability to pay a back-tax liability.These limits on monthly living expenses play a significant role in your ability to qualify for the Offer in Compromise settlement program and your Offer amount. The Standards are revised each year around the end of March.

Quick IRS Offer in Compromise Tip

If you’re preparing your OIC for submission toward the end of March, consider waiting a week or so before sending it to the IRS. It ma...

What if I can't afford to submit my OIC to the IRS

Jan 4, 2016 by

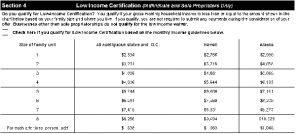

If you meet the Low Income Certification requirements, you will not be required pay the IRS $186 Offer in Compromise (OIC) application fee, nor will you be required to send in your first monthly payment or make monthly payments while your OIC is under review. See the table below and IRS form 565 for more information.

*Taken from IRS Offer in Compromise Booklet revised 01.2014

When you hire Fresh Start Tax Relief, we'll help you determine your total tax debt, your total penalty balance, your CS...

Can I sell my house if I have a tax lien?

Dec 28, 2015 by

An IRS tax lien affects different people in different ways depending on a lot of different circumstances. One concern we come across quite often is whether or not a delinquent taxpayer with an IRS tax lien can sell or refinance their home. Although a Notice of Federal Tax Lien makes it very difficult to do either, it's possible.

If you have an IRS tax lien that you cannot satisfy with a lump sum full payment and would like to sell your home, you will likely need to do two things. First,...

Payroll Deduction Installment Agreement

Dec 22, 2015 by

If you have a formal Installment Agreement with the IRS and are tired of sending in checks each month, one solution is the Payroll Deduction Agreement.

If your employer will agree to it, use IRS form 2159 to have your monthly IRS Installment Agreement deducted directly from your paychecks. This may decrease your chances of submitting a late payment or missing a payment altogether.

Contact Fresh Start Tax Relief today. Our fee is $499 no matter how much you owe the IRS.

Retirement and Insurance Accounts in an Offer in Compromise

Dec 14, 2015 by

The IRS Quick Sale Value multiplier on most assets is 80%. In other words, the Service will value a $100,000 home at $80,000 for Offer in Compromise purposes. But, 80% isn't used for all assets. And, some assets have exclusion amounts that will be subtracted from the Quick Sale Value.

Retirement Accounts are valued at 70% by the IRS for Offer in Compromise purposes while the current cash value is used for Whole Life Insurance accounts.

If you owe the IRS back taxes and want to know more ...

IRS Refund Statute Expiration Date and Penalty Abatement

Dec 7, 2015 by

IRS Refund Statute Expiration Date and Penalty Relief

Did you know that the IRS has something called the Refund Statute Expiration Date (RSED)?

The IRS is prohibited from issuing a refund of abated penalties and interest on a full paid account if the RSED has passed.

The Internal Revenue Manual section 25.6.1.10.1.1(6) states:

a claim for credit or refund must be filed within 3 years from the time the return was filed or 2 years from the time the tax was paid, whichever is later.