Tax Relief Blog

Category:

Fresh Start Tax Relief System

IRS Account Transcripts

Aug 17, 2015 by

Are you wondering how to get started resolving your own tax debt? A great place to begin is your Account Transcript(s).

If you don't want to draw attention to yourself by contacting the IRS in person or via telephone, request your transcripts online here at IRS.gov. You can choose to view them immediately online.

Your Account Transcript will give you a line by line explanation of transactions on the account. It will help you determine the following.

- Adjusted gross and taxable income

- Tax ...

be the first to add a comment

What If I Need More Help?

Aug 10, 2015 by

Fresh Start Tax Relief charges a one-time, flat fee of $499. Included:

- Research and investigate your IRS collection case,

- Compile your tax compliance report,

- Review your IRS Collection Potential,

- Provide you with n in-depth tax resolution consultation, and

- Provide you with a written guide to help you implement your resolution.

A Valuable Tool for Tax Return Preparers

Aug 3, 2015 by

If you are a tax return preparer that has clients with looming IRS tax liabilities, Fresh Start Tax Relief may be a useful tool for you.

Many tax return preparers don't have the necessary experience it takes to effectively negotiate federal back tax liabilities. Fresh Start's system allows tax professionals to capitalize on the back tax resolution opportunity when their clients present it.

Contact Fresh Start and we will investigate your client's IRS collection case, review their Colle...

Do You Need Full Tax Representation Before the IRS?

Jun 29, 2015 by

At Fresh Start Tax Relief, an educated consumer is our best customer. We help capable taxpayers that have fallen behind with the IRS resolve their own tax debts at a fraction of the price of other tax resolution firms.

If you need full service tax resolution, we can provide you with that option through M&M Financial Consulting, our parent company. But the truth is that most individuals with federal tax liabilities are in a position to resolve their own tax debt directly with the IRS. Mo...

What is a fair price to resolve your IRS income tax debt?

Jun 15, 2015 by

There are a lot of tax resolution companies out there vying for your business. I would say between 150 and 200 national companies. You may think that choosing from this pool of options is a difficult task. But, I don't.

To me the choice is clear. If you are willing to put a few hours of your own time into resolving your IRS back tax debt, then Fresh Start Tax Relief is the clear choice. We will investigate your IRS tax account and show you the steps needed to resolve your IRS income t...

Notice of Tax Lien Investigation

Jun 1, 2015 by

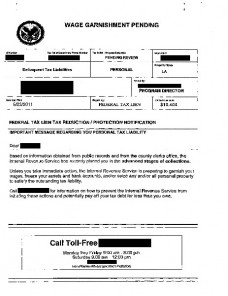

Have you received a "Notice of Tax Lien Investigation", "Wage Garnishment Pending" or "Tax Reduction/Protection Notification" in the mail?

Read it carefully. This may be a marketing ploy from a tax resolution company. They disguise their mailers to look like official IRS letters and notices. It gets a response from a lot of worried taxpayers that think they're contacting the IRS or state. To me it's a trick and has no place in Fresh Start's marketing. Here's an example of one.

...

Do Tax Resolution Services Work?

May 26, 2015 by

Do tax resolution services work?

Yes! But you need the right representation at a reasonable cost. Read more here.

How do I know if it will work for me specifically?

This will depend on your personal expectations and circumstances. In most individual IRS tax debt cases, a well planned phone call or two can resolve your income tax liabilities directly with the IRS. And, most people can do it themselves. They just need some initial guidance. Read more here.

What can a tax resolutio...

Fresh Start Tax Relief for Over the Road Truck Drivers

May 18, 2015 by

Over the road truck drivers keep the economy moving by delivering goods everyday across the country. Life on the road means that some things get put on the backburner. Sometimes taxes are left there for a while and back tax debts pile up.

Fresh Start Tax Relief can help you gain control of your back tax liabilities by contacting the IRS on your behalf to research and investigate your account. We'll also help determine the best way to resolve and reduce your back taxes through government...

Fresh Start Tax Relief in Conjunction with Your Accountant

Apr 13, 2015 by

Fresh Start Tax Relief is happy to work with your CPA or accountant to help you resolve your tax debt. Many of my past clients have had a trusted tax advisor for years. But that person didn't have the knowledge or experience to resolve their IRS back taxes efficiently and effectively.

With help from Fresh Start Tax Relief, you and your trusty accountant can resolve your back taxes without the anxiety and high fees that come with signing over IRS Power of Attorney to a stranger.

Fresh ...

Get Your IRS Account Transcript

Mar 30, 2015 by

Fresh Start Tax Relief's service includes obtaining IRS Account Transcripts for our clients. We then review and analyze the transcripts to help determine penalty and interest amounts, compliance and threat of enforced collection actions such as bank levies and wage garnishments.

You can get started on your own investigation and compliance check by ordering your own transcripts online. Get them directly from the IRS here.

If you need help ordering and analyzing your IRS transcripts, call u...

Execute Your Tax Resolution Plan

Mar 23, 2015 by

Execute Your Tax Resolution Plan

Execute Your Tax Resolution Plan

You've heard it before. Ideas are a dime a dozen, execution is priceless.

Keep this in mind when resolving your IRS tax debt. Whether you hire a professional to represent you in front of the IRS or you're doing it yourself, you will need to execute your part of the strategic plan to resolve your tax liabilities.

You can have the perfect strategy to fix your back taxes and reduce your total liability, but if you don't take action and implement the necessary step...

Guided Tax Relief with form 8821

Feb 23, 2015 by

Fresh Start Tax Relief is able to research and investigate our clients' IRS collection cases using IRS form 8821, Tax Information Authorization to request relevant information from the Service. This helps us determine the best resolution strategy for your specific situation.

Along with our research and investigation results from your case, we consider your Collection Potential (using form IRS 433-F or 433-A) to match the best solutions available to your particular needs. We are able to t...

Informed Consumer Is Our Best Customer

Jan 24, 2015 by

If you recently had an IRS tax lien filed against, you've likely received several phone calls and letters from companies wanting to help you resolve your back taxes. A lot of these companies use scare tactics to get you to hire them. All of them, to some extent, are betting on you sticking your head in the sand to avoid dealing with the IRS.

If you recently had an IRS tax lien filed against, you've likely received several phone calls and letters from companies wanting to help you resolve your back taxes. A lot of these companies use scare tactics to get you to hire them. All of them, to some extent, are betting on you sticking your head in the sand to avoid dealing with the IRS. They don't want you to research your resolution options. They want do want you to believe that the IRS is too difficult and complicated to navigate...

Legitimate Tax Resolution Companies

Jan 19, 2015 by

Most of the large tax resolution companies that scammed people out of millions of dollars are gone. Tax Masters, American Tax Relief and a few others no longer exist. The scary thing about tax resolution companies these days is whether or not they will be around tomorrow and their fees.

Fresh Start's parent company, M&M Financial Consulting, Inc., will be celebrating 10 years in business in 2015. M&M Financial and Fresh Start Tax Relief have a solid track record of resolving tax liabiliti...

Cost of IRS Representation

Jan 5, 2015 by

A big question amongst those of you with back taxes owed to the IRS is regarding the cost of IRS representation. Just about everyone would hire a professional if the price was right.

If you talk to five different tax resolution companies and get a fee quote from each of them, you'll likely end up with five different resolution strategies with five different fees. Both the resolution strategies and fees may range from reasonably to way out of the ballpark.

At Fresh Start Tax Relief, ou...

Legitimate Tax Resolution Companies

Dec 15, 2014 by

How do I know if a tax resolution company is legitimate?

Good question. It takes a little bit of research to determine whether the salesman on the other end of the line is telling you the whole truth.

Beware of promises and buzz words designed to hook your wallet.

There are a lot of good tax resolution companies and representatives out there. You just need to do your homework on each of them. Start with Fresh Start Tax Relief. Contact us to find out how our service can help you....

Fresh Start Tax Relief for Realtors

Dec 4, 2014 by

Realtors and other real estate professionals often find themselves in back tax trouble with the IRS. Fresh Start Tax Relief is the perfect solution. We'll help you resolve your current IRS back tax debt and advise you how to avoid more back tax headaches in the future.

Our fee is $499. Call us today to find out how our Guided Tax Relief system can help you get out from underneath your IRS back taxes.

Tax Resolution Companies and High Fees

Aug 25, 2014 by

If you're considering hiring any of the companies listed below to help you resolve your IRS back taxes, contact Fresh Start Tax Relief first. Our $499 Service is outlined here. Even if you don't hire us, you'll learn something about your back tax debt. Securing a solution to your IRS tax problem may not be as difficult as these other companies make it out to be.

Call Fresh Start Tax Relief at 866-937-5079 or complete our contact form to the right.

2020 Tax Resolution

911 Tax Relief

A...

Tax Resolution Fees

Aug 11, 2014 by

Reasonable fees are always a concern when you're looking help resolving and reducing your back IRS taxes. Depending on your case, tax resolution companies charge anywhere from $500 for an investigation only up to $10,000+ for larger cases.

Fresh Start Tax Relief's fee is $499. It doesn't change. Here's what you get.

- Investigation of your IRS back tax case

- Analysis of your Collection Potential to determine your best resolution options

- A copy of your IRS Account Transcript...